Matt Badiali’s latest recommendation for his investing followers is silver. His short newsletter about it was published on Banyan Hill recently. Although some readers may not believe that silver is a good investment right now, Matt explained why it is a strategic choice. Matt Badiali’s history as a geologist makes him a reliable source of information for any natural resource investments and especially for metals. He successfully predicted the rise of base metals before, and his insights helped many of his followers.

Matt Badiali’s Geology And Investing History

Matt Badiali used to travel to multiple places around the globe when he worked as a geologist. As a hands-on researcher, he traveled to mines and oil fields to inspect equipment and operations. He talked to workers, and he learned about all local issues that affected natural resources. From culture and politics to complex economic factors, Matt knows how to find in-depth insights to form and support his predictions. He spent over 20 years doing geology work. His jobs took him to places such as Singapore, Hong Kong, Papua New Guinea, Switzerland and many other countries. Eventually, he developed an interest in investing and became good at it. When he combined his dual skills, he became a trusted investment adviser. Matt is the editor for the Front Line Profits and Real Wealth Strategist newsletters. His reputation made him a good addition to Banyan Hill’s editorial staff.

Current Silver Trends

In his newsletter, Matt Badiali said that silver hit $14.15 in early September. Since the beginning of 2016, that was its lowest point. It was only 50 cents away from another low point in 2015. When silver hit its 2015 low point, it marked the biggest dip since the Great Recession. Although silver is still hovering at a low point, Matt Badiali is not surprised. Precious metals are not popular choices for investors right now.

On September 11, silver dropped for a while to $13.98 in the morning. However, it gained momentum again as the dollar took its own dip. The U.S. Dollar Index or DXY dropped below 95 but increased to 95.2 by the end of the day. When the day closed, silver was at $14.14. On Wednesday, the DXY fell below 95 in the morning and spent the rest of the day in that rut. By the afternoon, silver rose to $14.26. In the days following that, the DXY stayed under 95 most of the time. With the DXY’s weakness, silver found a strength increase. At the end of the week, silver was at $14.06. Fears of trade wars sent the DXY lower, and China’s unwillingness to negotiate a deal did not create any confidence. The dollar suffered even more. By the beginning of the following week, silver was at $14.23.

There are several other investment experts who are saying that silver will reach high points soon. Some say that it will reach a three-digit price. One of the most optimistic predictions for silver is $130 within the next several years. Experts say that it is undervalued and that conditions are ideal for it to rise again soon. For example, overvalued markets, low interest rates and a high-debt monetary system are all factors that may help silver make a comeback soon. Investing experts say that silver mining has entered a bull market.

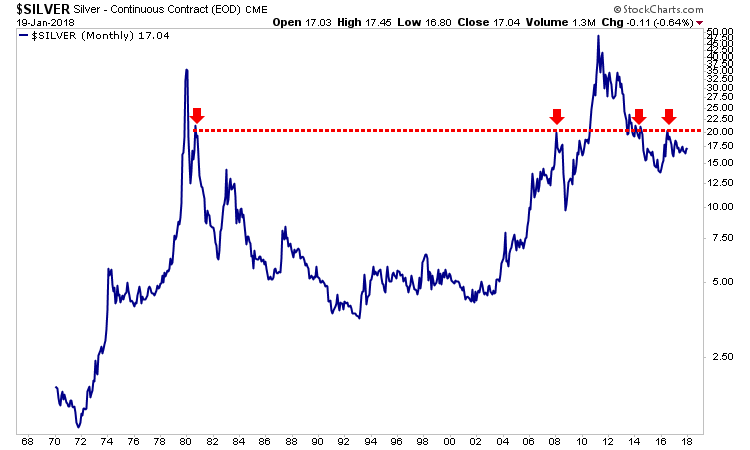

If silver rises, experts are not sure yet how far it will go. Its historical data shows that it was just under $50 in the early 1970s. In 2011, it nearly reached that point again. However, its highest point in 2018 was about $17.60. According to a recent survey, analysts predict that silver will climb to $17.80 by the end of the year. At the same point in 2019, they predict that the precious metal will reach $19.20. Most investment advisers expect it to increase marginally during the next several years. However, if there are other shifts in related markets, it could increase more.

Safe Havens And Silver Investments

With the shaky worldwide economy, the American dollar became a safe haven recently. It is viewed as a shield against economic uncertainty. Wealthy people from Europe, Venezuela, Argentina and Turkey are buying U.S. dollars to potentially combat a global economic decline in the coming years. However, Matt Badiali said that their choices were not ideal for them. He acknowledged the dollar as the best option in a poor currency market. He mentioned that cryptocurrencies also reeled in $190 million.

About a decade ago, that money was put into silver and gold. Those funds represent people who are worried about government-backed currencies. They view U.S. dollars as IOUs from the government and do not trust that they are backed by anything solid. The people who are investing in cryptocurrencies today are the same ones who wanted something tangible in the past. In the event of the dollar losing its value, they wanted something that would retain its worth. Although cryptocurrencies are not tangible, people invest in them because they trust them as much now as they trusted silver and gold eight years ago.

With a new alternative and a stronger U.S. dollar, the price of silver is staying low right now. However, Matt Badiali said that the fundamentals have not changed with silver. It is still a strong long-term investment. At the beginning of the year, exchange-traded funds accounted for 670 million ounces of silver. That was a record number for ETFs in relation to silver. Industrial companies represented the largest consumption of silver during the past year at 60 percent. Green energy is a growing trend across the world, and it requires silver. More than 1.5 billion ounces of the precious metal will be used for green developments by the year 2030. For solar purposes, more than 820 million ounces will be used by that time. The remainder of the percentage is comprised of electric car construction.

According to Matt Badiali, the silver supply decreased by about two percent, and mine production dropped by a little more than four percent between 2016 and 2017. However, he said that fundamentals are not as important in today’s market. Since the world feared an economic decline, silver’s growth slowed considerably. Today, Matt Badiali says that silver is an excellent speculation. Emotions of investors pushed silver away from its normal value. This is why Matt Badiali is recommending it as a good investment now. He said that an ounce of gold is worth more than 84 ounces of silver. That is the highest point since 2008 for the ratio. The historical average ratio has always been about 65 ounces of silver for an ounce of gold. As Matt pointed out, the average ratio makes the current ratio an extreme. Since 1995, the silver-to-gold ratio only reached that point five times. In his newsletter, Matt provided a chart as a visual aid.

Since people are still clinging to the fear of slow growth around the globe, the price of silver will remain low for a while. Matt Badiali pointed out how silver grew after its low points and how much money it brought investors after each point. Investors who bought silver at other historic low points made double-digit profits from modest investments. Silver went up to $48 per ounce from just $10 per ounce in 2008 after the market’s recovery. It rose by 38 percent in 2016 after it hit an extreme. For the referenced extremes, silver produced an average gain of 110 percent. However, its price never fell significantly. For investors who know how extremes and recovery periods work with precious metals, this opportunity should be clear. Matt recommends that his readers consider more silver investments as the year comes to a close soon.

Keep Reading: Investment Manager Says That Social Media Stocks To See Bigger Sell-Off As More Data Issues Come To Light

Dil Bole Oberoi