Anyone who has reached either financial independence or financial freedom is able to tell you that they reached their goals by having one strength: consistency. Consistency is described as “conformity in the application of something.” To win with money, you must fully conform to the plan of action that you have created for yourself.

What If You Hit A Bump In The Road?

It’s simple and common to initially be fully pumped and eager to budget, get out of debt, and build wealth. Putting pen to paper and creating a solid plan is a great first step. However, that’s the easy part. To see your goals come to fruition, you must keep going when the going gets tough.

There’s no doubt that it’s going to rain. But when one is winning with money, there is an emergency fund that is either fully funded or is being funded. Don’t get discouraged if you have to dip into your reserves to pay an unexpected expense.

Remember that sometimes, everyone experiences a bit of rain. What you would do in this situation is pay the expense, take another look at where you are financially, and begin again, starting with repleting those emergency funds.

How Can The Journey Be More Enjoyable?

We all would like a smooth ride. Unfortunately, as we mentioned before, it will sometimes rain, but we can prepare for the rain by preparing umbrellas.

An umbrella is an item that covers you from the elements. It is, in short, protection. Many people refer to their umbrellas as “slush funds.” Slush funds are simply funds that have been earmarked for certain events. A few ideas for slush fund accounts include:

- Vacations

- Birthdays

- Holidays

- New Car

To help you to see your financial progress, you can keep your slush funds in paper envelopes or you can open multiple free checking accounts.

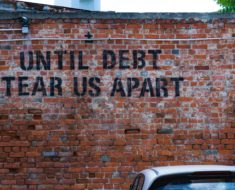

No One Has Ever Won By Giving Up

As humans, we are often times tempted. There’s no doubting that. Sometimes, we’d like to stray from our budgets. What we must keep in mind, however, is that if we stray from a particular area, we leave it; we’re no longer there.

That is to say that if you stray from your budget and get off track, then you are, in short, off track. Keep yourself encouraged by reading consistency-related blogs, listening to podcasts, or by keeping accountability partners.

View your budget regularly, daily if need be, to remain reminded of your goals and to keep on top of things. Remember that you can achieve your financial goals if you apply the strength of consistency.

Dil Bole Oberoi