The Dow Jones opened to a mild decline on Monday, September 23, 2019. Analysts did not expect to see a big jump in the Dow or the NASDAQ. Too much negative news pointed to troubles in the market. Ironically, the dips come after the Dow Jones experienced positive rallies leading towards a new boom.

Unfortunately, the global economy is fickle. Various uncontrollable factors play a role in whether the stock market maintains glowing numbers. The troubling incidents emerged to drive down the Dow’s numbers on the open.

Trade talks between China and the United States turned rocky again. Representatives intended to meet in Montana to discuss progress. The Chinese representatives, however, pulled out. So, any hopes for a breakthrough dimmed. Initially, the market drove upwards, in part, because it looked like both sides wanted to end the trade war. Canceling high-profile talks indicates much more work is required.

Things are not all perfect in Germany. Manufacturing no longer appears as healthy as it once was. The decline in manufacturing, for all intents and purposes, is helping drive Germany into a recession. Some even said Germany already found itself in an unofficial recession. The U.S./China trade war played a part in Germany’s woes, although other issues might factor in as well. Regardless of the reasons, a weakening German economy ripples through Europe and the globe.

Boeing also suffered stock price troubles after news emerged that poor aircraft design and oversight issues contributed to the crash of a 737 airliner in Indonesia. The tragic airline disaster saddened people around the world, and many awaited the outcome of the official investigation. With Boeing at fault, the company’s stock dropped more than 1.2%. The overall stock market suffered as a result.

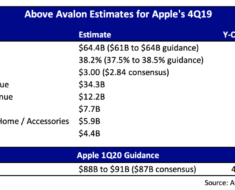

Interestingly, Apple’s stock continues to perform well. The tech company did make a comeback after experiencing a sharp decline in previous months.

The Dow Jones dropped a bit on the open, but it did not crash. The stock market always has its ups and downs. Investors do hope the market returns to its upward trajectory.

Dil Bole Oberoi