The price of Bitcoin has spiraled upwards in the last 24 hours and is now well above the $9,000 per Bitcoin price and it’s closing in on the $10,000 mark. The last time Bitcoin was trading at this level was in September last year. At the same time, gold which is considered a safe-haven asset has also soared as a result of anxiety that has been brought about by the spread of coronavirus.

Analysts are attributing Bitcoin’s increase in price to geopolitical unpredictability. But they are not designating it as a safe haven asset just yet. But according to Mati Greenspan, the founder of Quantum Economics, there is a persistent feeling that Bitcoin is moving into the safe haven asset. He admits that it hasn’t reached there but it’s on its way there.

Some market watchers had suggested that Bitcoin price would plummet, because of decreased trading volume, over the Lunar New Year Weekend but this was not the case. Adam Vettese, a market analyst at brokerage eToro observes that the price of Bitcoin and other major crypto assets have skyrocketed in the past week, almost reaching a three-month high, because investors are looking for substitutes of equities. After a 12% resurgence in three days Bitcoin hit the heights of $9,389, the highest it has been since November last year when it had gone past $9,400. Coindesk.com reports optimists expect that the Bitcoin halving set for May this year and improvement to its network will make the price go to a new level of high.

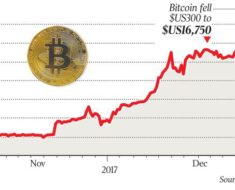

Vijay Ayyar the head of Luno Asia told CNBC that majority of people are ignorant about Bitcoin and predict that they will start buying once they see the prices going up something that has happened before. The halving is scheduled for May, and even the surge in price that we are witnessing is because people have their eye on May. Ayyar speculates that Bitcoin will hit $16,000 by year end. Bitcoin bears are reminiscing of when the price was $5,000 and $6,000, they claim that the smart people bought aggressively when the price was this low.

Dil Bole Oberoi