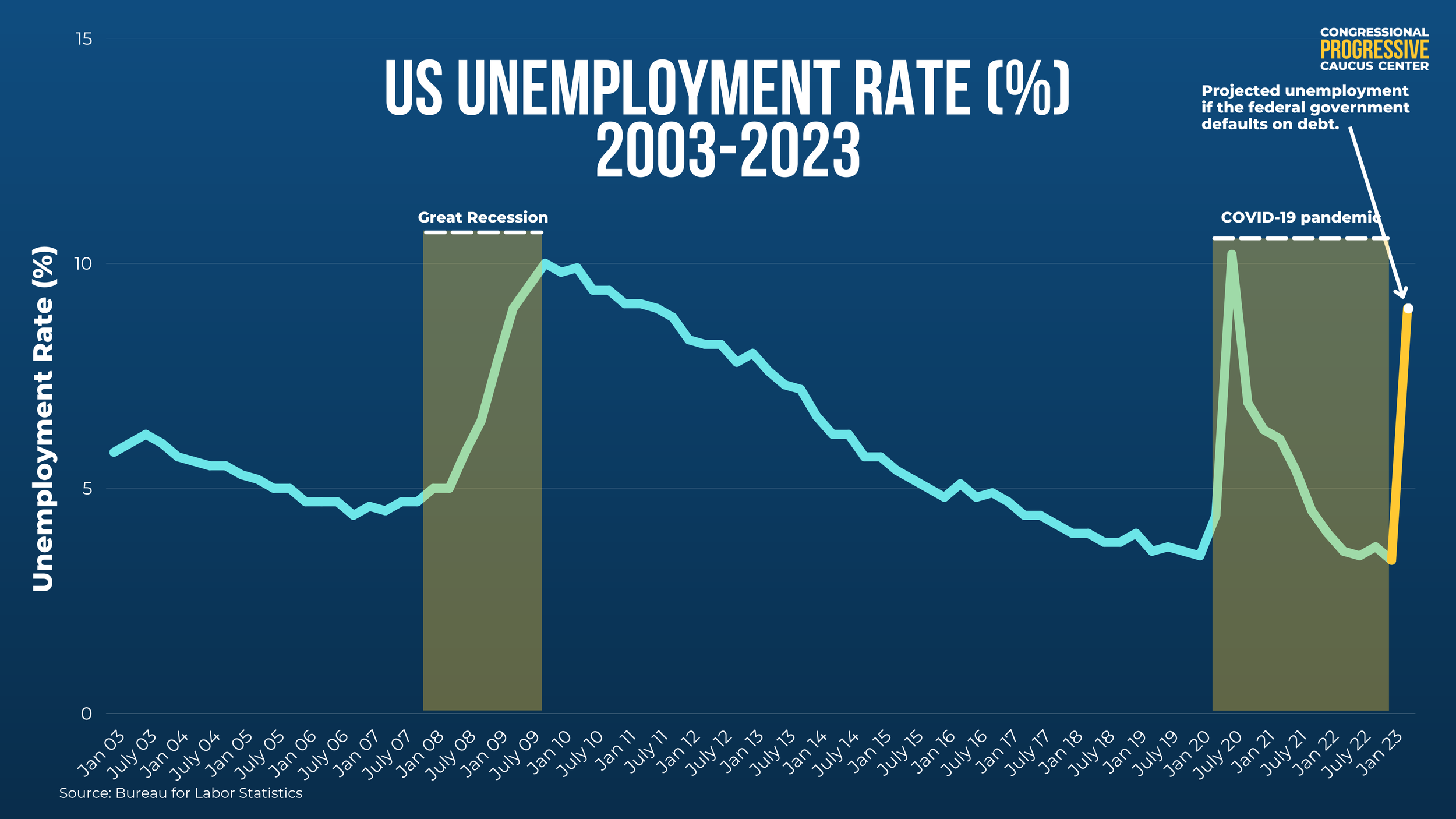

The U.S. government is facing a looming deadline to raise or suspend its debt ceiling, which is the legal limit on how much money it can borrow to pay its bills. If Congress fails to act by early June, the Treasury Department will run out of cash and be unable to meet all its obligations, such as paying interest on its debt, sending Social Security checks, funding the military, and reimbursing Medicare providers. This would have serious consequences for the U.S. economy and its global reputation, as well as ripple effects for other countries that rely on U.S. trade, aid, and financial stability.

#What happens if the U.S. can’t raise the debt ceiling?

The debt ceiling is not a measure of how much the U.S. government spends or owes, but rather how much it can borrow to finance the spending that Congress has already authorized. The U.S. has been running large budget deficits for years, meaning it spends more than it collects in taxes and other revenues. To make up the difference, it has to borrow money by issuing Treasury bonds and bills, which are bought by investors around the world who see them as safe and reliable assets.

The U.S. hit its current debt limit of $31.4 trillion in January 2023, but the Treasury Department has been using various accounting tricks, or “extraordinary measures”, to keep paying its bills on time. However, these measures will be exhausted in early June, and the Treasury will run out of cash to cover all its payments. At that point, it will have to prioritize some payments over others, or delay them until it has enough money available.

This would effectively mean that the U.S. government would default on some of its obligations, which has never happened before in its history. Defaulting on its debt would be especially damaging, as it would erode the trust and confidence that investors have in U.S. Treasuries, which are considered the bedrock of the global financial system. This could trigger a sell-off of U.S. bonds, driving up interest rates and increasing borrowing costs for the government, businesses, and consumers. It could also spark a panic in the stock market and other financial markets, leading to a loss of wealth and a contraction in economic activity.

Even if the U.S. avoids defaulting on its debt, missing or delaying other payments would also have negative impacts on millions of Americans who depend on government benefits and services, such as Social Security recipients, veterans, federal employees, contractors, and health care providers. It would also harm the credibility and reputation of the U.S. as a reliable partner and leader in global affairs, undermining its ability to project soft and hard power around the world.

How much does the U.S. owe China?

One of the main reasons why some lawmakers oppose raising or suspending the debt ceiling is their concern about the growing national debt and its implications for future generations. As of June 2023, the total national debt stands at more than $32 trillion, or about 140% of gross domestic product (GDP). About $23 trillion of this debt is held by the public, which includes domestic and foreign investors, while about $9 trillion is held by various government agencies.

Among foreign creditors, China is one of the largest holders of U.S. debt, owning about $1 trillion worth of Treasuries as of March 2023, according to the Treasury Department’s data. This represents about 4% of the total public debt and about 7% of the foreign-held debt. China’s holdings of U.S. debt have fluctuated over time, depending on its trade surplus with the U.S., its exchange rate policy, and its diversification strategy.

Some critics argue that China’s ownership of U.S. debt gives it leverage over U.S. policies and actions, especially amid rising tensions between the two countries over trade, technology, human rights, and security issues. They fear that China could use its holdings as a weapon to pressure or punish the U.S., either by selling them off en masse or by refusing to buy more in the future.

However, most experts agree that China’s influence over U.S. debt is limited and overstated, as both countries have strong incentives to maintain a stable and mutually beneficial relationship in this area. For China, dumping U.S. bonds would hurt its own economy by devaluing its remaining holdings, disrupting global markets, weakening demand for its exports, and appreciating its currency against the dollar. For the U.S., losing China as a buyer would not necessarily cause a shortage of demand for its debt, as there are many other investors who are willing and able to purchase U.S. Treasuries, such as Japan, the European Union, and the Federal Reserve. Moreover, the U.S. has the advantage of issuing debt in its own currency, which gives it more flexibility and control over its monetary and fiscal policies.

What happens to Social Security if the U.S. defaults on its debt?

Social Security is a federal program that provides retirement, disability, and survivor benefits to millions of Americans. It is funded by payroll taxes collected from workers and employers, as well as by interest income from the Social Security Trust Fund, which holds about $3 trillion worth of U.S. Treasuries.

If the U.S. defaults on its debt, it could affect Social Security in two ways. It could reduce the interest income that the Trust Fund receives from its holdings of U.S. bonds, which would accelerate its depletion date. According to the latest projections by the Social Security trustees, the Trust Fund is expected to run out of money by 2034, after which it will only be able to pay about 76% of scheduled benefits from incoming revenues. A default could bring this date closer and lower the percentage of benefits that can be paid.

Also, it could force the Treasury Department to delay or cut Social Security payments to beneficiaries, along with other government obligations, if it runs out of cash and cannot borrow more money. This would cause immediate hardship and uncertainty for millions of Americans who rely on Social Security as their main source of income. It would also undermine public confidence and trust in the program, which is already facing long-term challenges due to demographic changes and rising costs.

The debt ceiling crisis is a serious threat to the U.S. economy and its global leadership, as well as to the well-being of millions of Americans and people around the world who depend on U.S. trade, aid, and financial stability. It is a self-inflicted problem that can be easily avoided by Congress taking timely and responsible action to raise or suspend the debt limit, which does not authorize new spending but rather allows the government to pay for what it has already committed to. Failing to do so would have catastrophic consequences for the U.S. and the world, and would damage the credibility and reputation of the U.S. as a reliable partner and leader in global affairs.

Dil Bole Oberoi