What, if anything, can blockchain-based infrastructures do for emerging markets? And what does crypto winter look like in those parts of the world, including Africa?

To answer these and other questions, Robby Greenfield, CEO and co-founder of Umoja Labs, had a lengthy and in depth conversation on Chris Brummer’s Fintech Beat podcast with Julian Ha, an executive recruiter with Heidrick & Struggles. Greenfield. With Greenfield reprising the conversation at the DC Fintech Week conference on a panel centering on “community based crypto”—we thought the episode was worth a second listen. And it didn’t disappoint.

Umoja Labs (formerly known as Emerging Impact) provides last mile payments infrastructure to aid agencies and FinTech’s so that they may provide affordable financial tools to some of the most underserved communities on the planet through their blockchain-based payments suite. Umoja is one of the very few cryptocurrency on and off-ramp providers that support emerging markets and their payment methods while partnering with and serving governmental agencies and major NGOs, such as Care International, Save The Children, and Oxfam International.

Greenwood began the conversation by introducing viewers to the origin story for Umoja Labs. He spoke about how Bitcoin was introduced to him in the engineering school at the University of Michigan and how his initial interest was reserved for just being a hobby. He recalled how it wasn’t until the murder of Trayvon Martin in 2012 that his obsession with blockchain technology took form around a purpose – the purpose being to how blockchain technology could be applied to social impact issues.

“Our mission is to radically change upward social mobility for millions of people at a time who are typically, a part of that, you know, 2 billion people who are unbanked or underbanked. A number that you constantly see tossed around…The good thing is that people have increasing access to technologies, but unfortunately there are not enough solutions built for those technologies, for them to interface with financial services or other things that they may want to be able to access, particularly for feature phones or what are all the otherwise called, just dumb phones or bricks. So the main difference for Umoja is that we’re focused on traditional financial use cases while also taking advantage of the cost that blockchain technology brings in contrast to what people might experience using mobile money or traditional financial payment methods. The cost is obviously a lot less, the transparency being a lot higher, just those two things alone and the way to effectively create programmable money.”

Greenfield catalogued several use cases for Umoja Labs, including:

1. Humanitarian organizations using the payment infrastructure to ensure 100% transparent humanitarian aid, which is faster and more efficient.

2. Providing financing to smallholder farmers and reducing the cost of mobile money remittances

3. Another interesting use case also revolves around how emerging markets begin creating their own local start-ups that use infrastructure provided by Umoja Labs to build for their communities. This materializes in a lot of different types of applications, eCommerce delivery apps, and health services.

Greenwood also mentioned how the blockchain payment structure is disrupting the market by providing a far less costly exercise. Blockchains such as Celo and Avalanche can provide cost savings of over a thousand times in comparison to traditional fees charged by telecommunication companies in countries such as Tanzania.

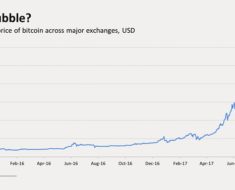

Greenwood and Julian Ha also discussed the crypto winter and how it had affected business in Africa.

“Crypto winters are unfortunately extremely cyclical. I think the more people and the more speculators that join the market, the worse they become. I think in the context of emerging markets, thankfully, I don’t think individuals have been too affected just because the average investment that somebody’s going to have in Nigeria or Eastern Africa is going to be a lot less than, you know, the average investment of an individual from the United States or from Europe, at least right now. You’re talking about thousands to tens of thousands of dollars in a Western context. And you’re talking about at most hundreds to low thousands of dollars in an emerging market context”, explained Greenwood.

The recent collapse of the algorithmic stablecoin TerraUST and its governance token LUNA sent ripples of fear across the entire FinTech world. The Umoja Labs CEO spoke about how NGOs like Oxfam and Save The Children have become sceptical about the use of cryptocurrency to run their applications, especially with a looming crypto winter. The silver lining, however, is that these organizations are further down their blockchain educational path which allows them to differentiate between what is being used within their programs and applications to what is not going well in the crypto market, which is essentially the stablecoins v general cryptocurrency debate.

Umoja also published a risk matrix recently, which they are now looking to republish, said Greenwood. The risk matrix provides an analysis of stable coins through which one can assess the legitimacy and safety of using certain stable coins with vulnerable populations. This will provide an excellent use case for NGOs and anyone else looking to use cryptocurrencies within their applications.

The episode ended with comments by Chris Brummer, the Agnes N. Williams Research Professor of Law and Faculty Director of Georgetown’s Institute of International Economic Law, and co-founder of the podcast. Having enjoyed an illustrious career across the public and private sectors, he is one of few Washingtonians whose focus remains fixed upon how financial technology tools may better serve minority communities and promote financial inclusion.

In his weekly rundown, Dr. Brummer provided a crisp entry way for future conversations, observing: “Umoja is a case in point by focusing on the technology stack enabled by crypto, as opposed to the narratives about getting rich overnight. Robbie is highlighting just how transformative the technology can be in the right hands, but even then it will take some doing not only in terms of getting capital to the people that understand local communities and economies but also from the regulatory community and an understanding from it that where rules aren’t devised wisely, they could end up hurting the very people they’re designed to protect by choking off the very diversity of perspective and brain power needed to solve real-world problems.”

Dil Bole Oberoi