Venture capitalist and entrepreneur Shervin Pishevar has been a force of nature in the investment world, going in early on Uber, airbnb, Postmates, and other tremendously successful startups. But he’s also shown something else: A knack for seeing which businesses are destined to be bought by much bigger companies. This is also known as an exit.

For some investors, having just two or three exits is a tremendous track record to be celebrated, because statistics show that as many as 90% of startups fail within the first four years. So to be able to show that you’ve seen some success out of all the chances you’ve taken as a super-angel or other type of investor, is definitely a good thing.

By that logic, with more than a dozen exits, super angel Shervin Pishevar is someone to learn from. So, out of all of his exits, which Shervin Pishevar investments were swallowed up by the big fishes? Here’s a list of the ones that delivered a hefty payday.

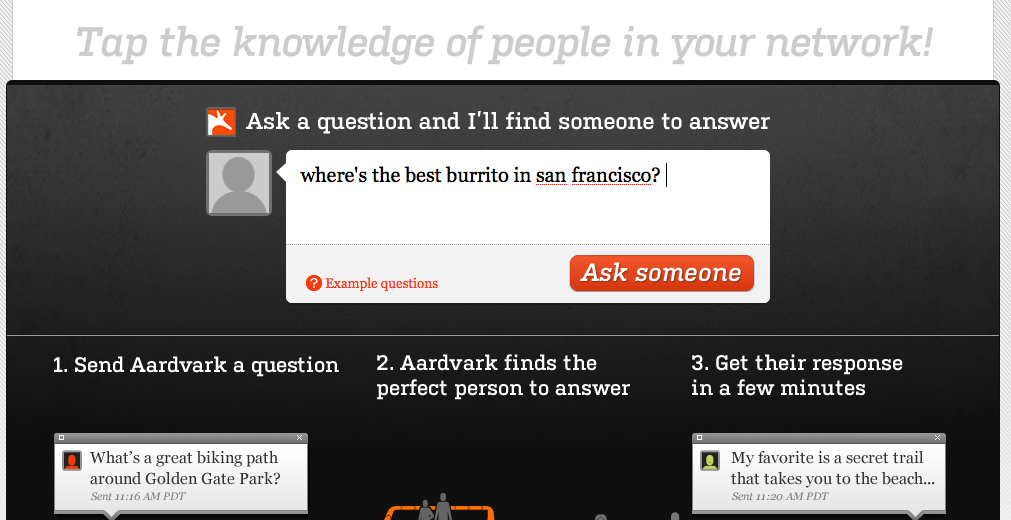

Aardvark: Bought by Google for $50 million

In 2007, a startup named the Mechanical Zoo created a search engine that they called Aardvark. Now, this was not just like any search engine, it was a social search engine. It was considered to be a “knowledge market” and here’s how it worked:

You first received an invite from Aardvark or a friend who was already an Aardvark member. When you joined, you were added to that person’s buddylist. Then you would then be asked if you wanted to answer a question from the community, which consisted of your friends in your buddylist.

Aardvark was different because it showed true collaboration on the questions being asked. For instance, if you wanted to ask “what color is a king snake?”, and your buddies thought that it would be better to ask “what colors are a king snake?” , your social friends could chime in to make the question better.

Another advantage to the startup was the way that your buddies could choose the best person to answer the question. So, for instance, if you were an expert in snakes, and your buddylist members knew this, they would refer snake questions to you.

Before Aardvark was bought by Google, venture capitalist Shervin helped fund the company. Aardvark had an initial investment of $750,000 via convertible debt, by angel investors, and then gained series A funding of $6 million. When Google bought Aardvark, here was part of the announcement on the Aardvark blog:

“As a first step, effective immediately, Aardvark will be available through Google Labs. Aardvark will remain fully operational and completely free, providing quick, helpful answers to all of your questions.”

As we move forward, we will continue working on Aardvark : improving its speed and quality, building exciting new features, responding to your feedback, and providing the highest level of support. Our top priority has been, and remains, providing a high-quality user experience.”

No doubt Google purchased Aardvark for its revolutionary code and folded it into its own tech, but entrepreneur and super angel Shervin saw a good thing early on, and this is an exit to be proud of.

Scan: Bought by Snapchat for $54 million

After launching his company in 2011, it was acquired by SnapChat in 2014 for a whopping $54 million, making Gee an instant millionaire.

The story of Scan, and how entrepreneur and venture capitalist Shervin Pishevar (and others) backed this project, is one of those tales beloved by investors far beyond Silicon Valley. It is a tale of one person and a dream, which quickly turned into an outcome far beyond the entrepreneur’s greatest hope.

Scan was a simple app used to recognize barcodes and QR codes. The twist on this app was that it allowed people to purchase items straight from a QR or barcode scan, rather than have to scan, go through a website, order, and then wait for whatever they bought in the mail. Another feature? Customers would receive alerts when prices were dropped for specific items.

This simple premise and set of features was attractive to super angel Shervin Pishevar, which is why the entrepreneur and venture capitalist funded it from early on. But there was much more to the whole thing that made it a good investment.

Scan was created by Garrett Gee, who, at the time, was a soccer captain at Brigham Young University (BYU). Garrett, while interested in being an entrepreneur at the time, had no clue about how to run or start a business. So he began to take business classes at BYU, in the hopes of absorbing what he was taught and turning what he learned into the next Uber or airbnb.

Even a teacher remembers Garrett’s enthusiasm for business, especially adjunct BYU professor John Richards, who says Gee took Introduction to Entrepreneurship three times!

“When I asked him why, he said, ‘Because I am here for an education, not a degree.’ He didn’t know what the word ‘entrepreneur’ meant when he met me in the first class. He took to it like water. He is a design genius.”

That same professor told the BYU newspaper that Gee was an avid learner, and what he didn’t understand in class, he researched online. He found two information systems students at the school, and hired them to develop Scan.

Like many entrepreneurs, Garrett didn’t have the money to pay the two development students, who had reputations for being the best in the school. So he offered them equity in the company. In three months, the pair developed the app. Soon the app had tens of thousands of downloads from the app store, and Garrett began meeting with investors and venture capitalists from Silicon Valley. Super angel Shervin Pishevar was one of those investors.

For Garrett Gee, it wasn’t enough to know how to create an app, he had to learn how to market it in front of venture capitalists and those representing large companies. Since he was still taking classes and on the road with the BYU soccer team, Gee had to take meetings with potential buyers in secret. After all his hard work, Garrett had numerous potential investors.

Late in 2014, Scan was bought by Snapchat for $54 million. For Gee, who leaned on Silicon Valley greats like super angel Shervin Pishevar to back his project, it was a dream come true. But since the deal itself was totally confidential, Garrett had to keep it a secret — even from his own family.

Only when Sony Pictures was hacked did the truth come out. And suddenly, everyone knew the dollar amount of the deal.

Garrett Gee continues to live a frugal lifestyle, and has traveled the world with his wife and children, even parlaying his adventures into an online show. However, Gee has stuck to his plan to not touch the money made in his transaction, with the exception of buying a house on Hawaii to live with his travel-savvy clan.

Parse: Bought by Facebook for an estimated $85 million

Venture capitalist Shervin Pishevar frequently seeks out investments that go against the grain. Parse, a mobile backend-as-a-service-startup was definitely one of these.

Venture capitalist Shervin Pishevar frequently seeks out investments that go against the grain. Parse, a mobile backend-as-a-service-startup was definitely one of these.

Parse was originally founded by a group of people who worked at Y Combinator and Google. The idea was to create back-end tools not for companies, but for mobile developers. Parse would allow mobile devs the opportunity to see all the data behind the scenes, beyond just download numbers.

Parse also allowed mobile app developers to manage logins, develop and run push notifications, and use the cloud to store data. It was an all-in-one solution for mobile app developers that gave total control and visibility into how their apps would fare.

Super angel Pishevar understood this when he heard about Parse, which is why he backed the project. But what’s most interesting is who bought Parse — and why.

Although Parse had a number of companies interested in making a purchase, Facebook ultimately bought the company for close to $90 million. Now, for a company like Facebook, this is pocket change. But for an analytics and data company, which Facebook has ultimately become, this was a smart move to deliver even more transparency for the companies who buy the data that Facebook delivers.

One theory about the Shervin Pishevar-backed company is that Facebook wants to find the next big thing in mobile apps. By purchasing Parse after super angel Shervin Pishevar and others had invested into the development of the service, Facebook would have a birds-eye view of what apps were becoming popular early on.

By knowing which apps were bringing in the most people, and even making the most money, Facebook could spot the next big thing in the early stages, and swoop right in and make an offer before it becomes far too expensive to buy.

Analytics are the big key to Parse, and some major developers and media companies were already using Parse by the time it was sold to Facebook. The Travel Channel and Food Network apps were already on board, alongside Hipmunk and Anypic. In fact, by the time Facebook took the venture capitalist-backed Parse off the market, an estimated 100,000 apps were already using it.

This unconventional deal was ideal for philanthropist and investor Shervin Pishevar, and it showed the world that not all high-profile deals have to be ones that fit the startup and acquisition mold.

Rapportive: Purchased by LinkedIn for $15 million

When the developers of Rapportive needed seed round funding, they called on venture capitalists — including super angel Shervin Pishevar — to raise a modest amount of money to continue development. As an email add-on that would show the info of your contacts down to where they were based, what they looked like, and what their line of work was, Rapportive received $1 million from investors to perfect what was already created.

So you can imagine the joy from J. William Fulbright scholar Shervin Pishevar felt when LinkedIn, the world’s biggest social network for business, swooped right in and bought the small company, with a pre-money valuation of just $3 million for $15 million.

What made Rapportive different than many services was two things. Rapportive worked exclusively for gmail, which was already becoming the de-facto business email client for companies large and small. Also, Rapportive would work well as a LinkedIn add-on, giving Linkedin the advantage of showing up as the main profile for whoever was being contacted in gmail. Open gmail, look up a name, and see their LinkedIn profile, make a connection. That was essentially the premise.

Later on, Linkedin would go on to rebrand Rapportive as Sales Navigator and make it a major lead-gathering tool for sales teams. It would continue to support it as Sales Navigator Lite in Gmail, but the real value for the social media company was in paid plans for sales teams.

LinkedIn’s CEO was quick to tell the world that Rapportive would continue to live on in LinkedIn, in this statement.

“Over the last two years, Rapportive has become an essential product for folks all around the world. When rumours of our acquisition surfaced last week, many asked what was going to happen to the product. Well, we have fantastic news: at LinkedIn, we will support Rapportive, and we will continue to build beautiful products that make you brilliant with people.”

Now, Shervin Pishevar’s investment lives on, only with a little more polishing and rebranding.

Gowalla: Acqui-hired by Facebook for an undisclosed amount

The vast majority of high-profile deals in Silicon Valley and beyond are the ones that are straight purchases. The usual formula? One large company buying a small one for a large amount of money.

But venture capitalist Shervin Pishevar, who has made all sorts of deals, as a super angel and investor, knows that deals don’t always take that familiar shape.

Gowalla is one of those deals. Gowalla was originally a social network based on location. Launched in 2001, it allowed users to check in at specific places in their local area, from restaurants to amusement parks to stores to hotels.

This concept was tailor-made for a larger social network, and no doubt Gowalla’s founders had exactly that in mind when they created their own smaller location-based social network. For investor Shervin Pishevar, who is so powerful that he convinced Elon Musk to take the first crack at developing design possibilities for the Hyperloop, funding Gowalla was a natural fit.

What helped make Gowalla a big splash was its launch at SXSW 2009. Competing heavily against Foursquare, Gowalla not only allowed users to check in at certain spots, but the company also offered virtual goods for users. Ultimately, even after a strong launch, Foursquare became far more popular than Gowalla.

Just two years after Gowalla launched, the company announced it had raised $8.4 million in venture capital funds. But in 2011, Facebook came in and bought the technology — and hired the Gowalla staff — for its own needs.

While the deal was veiled in secret (there was no announcement on how much Gowalla was sold for), the staffers at Gowalla announced that most of them would be moving to Silicon Valley to work at Facebook. A few would stay behind in Austin, where Gowalla was founded.

Despite the innovative design and technology behind Gowalla, Facebook bought the company and tech in December of 2011. In March 2012, Facebook shut down Gowalla. Founder Josh Williams stayed at Facebook for about a year and half, then left the company to create new startups in Silicon Valley.

It wasn’t an easy journey for Gowalla, which was only ever able to get a few million people to download their service. Ironically, Foursquare eventually dropped its consumer-focused approach, and rebranded as a location intelligence and data company.

As it stands, Hyperloop founder and venture capitalist Shervin Pishevar has a number of other exits to brag about, from Milo, bought by eBay, to TaskRabbit, which was ultimately acquired by furniture and design giant Ikea. Others investments were bought by Yahoo, Autodesk, Opentable, and even Datto. But philanthropist Shervin is also awaiting more growth — or exits — on companies like Slack, fair, and even robinhood.

With an astonishing portfolio with airbnb, Uber, Postmates and AngelList, Silicon Valley’s top investor, Shervin Pishevar, is a force to be reckoned with. In fact, super angel Shervin is so influential, many people — investors and non-investors alike — follow him on Twitter just to learn which investments are hot, which aren’t, and what type of companies are leading us into the future.

Dil Bole Oberoi